Senior Living Costs in California: A Complete Guide for Families

Published: 12/26/2024

Choosing senior care for a loved one is both an emotional and financial decision. With the high cost of living in California, families often face uncertainty about how much senior care will cost—and how to plan for it. This page will help you compare costs, understand pricing models, and explore ways to pay for senior living in California.

How Much Does Senior Living Cost in California?

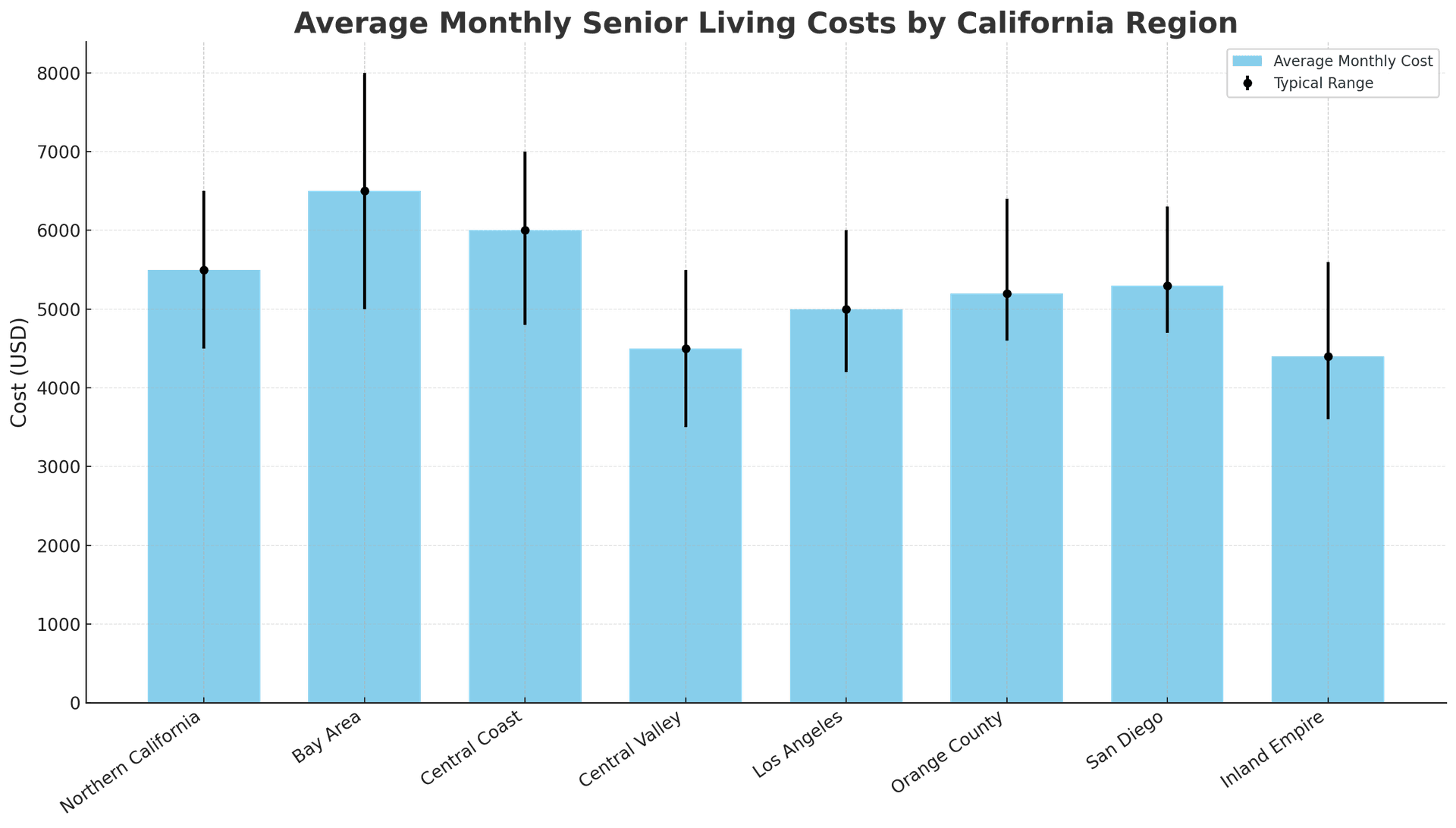

The cost of senior living in California varies based on care level, location, and amenities. Below is a general overview of average monthly costs in 2024:

Sources: Genworth 2024 Survey, CA provider directories

What’s Included in the Base Cost?

Most assisted living communities in California charge a monthly fee that includes:

- A private or shared apartment

- Three meals a day, plus snacks

- Housekeeping and linen service

- Transportation to appointments

- Wellness activities and social programs

- 24/7 on-site staff

- Basic support with daily tasks (like dressing, grooming, medication reminders)

However, not all services are included in the base rate. In many cases, additional care is priced separately and added to your monthly bill.

How Pricing Works: Flat Rate vs. Tiered Costs

Assisted living communities typically use one of two pricing models:

- All-Inclusive Pricing A single monthly fee covers all housing, meals, and care services—ideal for predictable budgeting but often higher up front.

- Tiered or À La Carte Pricing You pay a base fee for housing and meals, and then add services (like bathing assistance or medication management) as needed. This can start lower but grow over time depending on your loved one’s care needs.

Families should ask for a care needs assessment before move-in to understand what’s included, what’s extra, and what price increases to expect over time.

Memory Care and Specialty Services

If your loved one has Alzheimer’s, dementia, or a complex medical condition, they may require memory care or specialized services. These typically cost 20–30% more than standard assisted living. In 2024, memory care in California averages between $6,500 and $8,000 per month.

Memory care includes:

- Higher staff-to-resident ratios

- Secured environments for safety

- Structured cognitive and sensory activities

- Enhanced support for behavior and mobility

What Makes the Cost Go Up?

Several key factors affect assisted living pricing in California:

- Location – Facilities in cities like San Francisco, Los Angeles, and San Diego tend to be more expensive than those in rural or inland areas.

- Level of Care – Residents needing more hands-on support will pay higher monthly fees.

- Apartment Size – A private one-bedroom or deluxe suite will cost more than a shared room or studio.

- Amenities – Pools, salons, fitness classes, gourmet dining, and concierge services can all increase costs.

- Staff Training & Ratios – Communities with higher staff qualifications or better staff-to-resident ratios may charge more—but also offer higher quality of care.

Do Costs Go Up Over Time?

Yes. Most communities increase rates annually—typically 3–5% per year to account for inflation and labor costs. In some cases, costs may also rise if your loved one’s care needs change and they require a higher service tier.

Tip: Ask each community how often they review care levels and when rate increases are communicated. Some communities conduct quarterly reassessments, while others only update annually.

Ways to Pay for Assisted Living

Assisted living is primarily a private-pay expense, but there are several strategies and programs that may help:

- Personal Funds – Income, savings, or help from family members

- Home Equity – Via sale, reverse mortgage, or rental income

- Long-Term Care Insurance – If purchased earlier in life, this can offset monthly care costs

- Veterans Benefits – Veterans and spouses may be eligible for the VA Aid and Attendance benefit

- Medi-Cal Assisted Living Waiver (ALW) – Available in select counties for those who meet income and care criteria

- Life Insurance Conversions – Some policies offer “living benefits” that can be applied toward senior care

What Families Can Do Now

Planning ahead makes all the difference. Here’s what you can do today:

- Get a Care Assessment – Know what level of support your loved one will need.

- Compare Communities – Don’t just compare price—visit, observe staff, and ask current families about their experience.

- Request a Detailed Fee Schedule – Understand what’s included and what’s billed separately.

- Review Annual Increase Policies – Ask how often rates rise and how you’ll be notified.

- Explore Financial Options – Speak with a senior care advisor or benefits expert about eligibility for VA or Medi-Cal programs.

Final Thoughts

While assisted living in California can be a significant investment, the right community offers peace of mind, safety, and a better quality of life. By understanding how pricing works—and asking the right questions—families can plan with confidence and avoid unexpected costs.